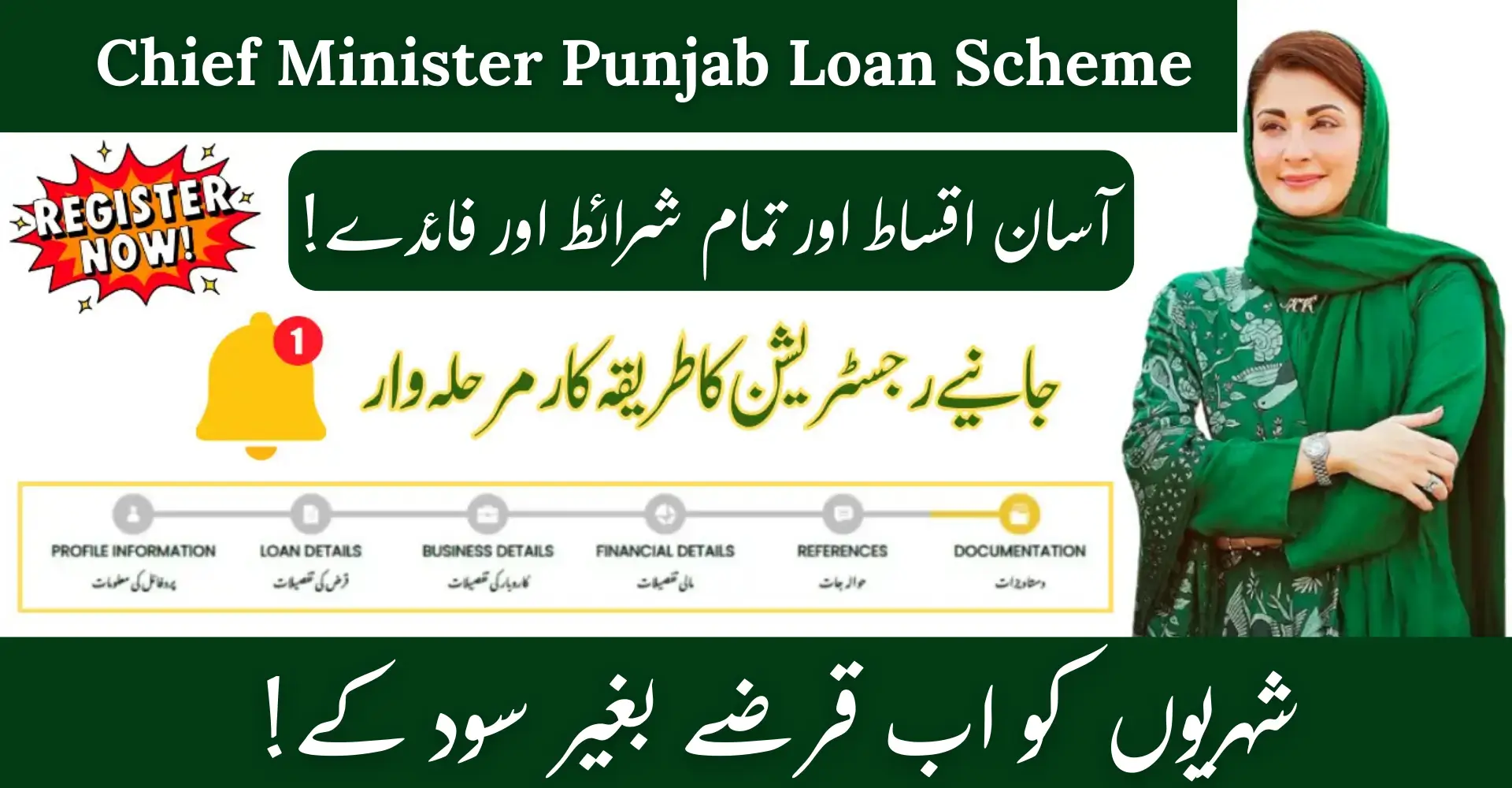

Chief Minister Punjab Loan Scheme. The Chief Minister Punjab Loan Scheme 2026 helps people start or grow a business without heavy financial pressure.

If you are looking for interest-free business loans in Punjab, this guide explains everything clearly, step by step.

What Is the Chief Minister Punjab Loan Scheme 2026?

The Chief Minister Punjab Loan Scheme 2026 is a government-backed financing program launched under the leadership of Chief Minister Punjab.

The scheme provides interest-free and low-interest loans to youth, women, and small business owners across Punjab. The goal is simple.

Support self-employment. Reduce unemployment. Strengthen small businesses.

Loans range from PKR 100,000 to PKR 5 million, depending on business size and category.

CM Punjab Loan Scheme 2026 – Quick Overview

| Feature | Details |

|---|---|

| Loan Amount | PKR 100,000 – PKR 5,000,000 |

| Interest Rate | 0% to 5% |

| Repayment Period | Up to 5 years |

| Eligibility Age | 18 to 50 years |

| Residence | Punjab only |

| Target Groups | Youth, women, SMEs, differently-abled |

| Application Mode | Online |

| Official Portal | punjab.gov.pk |

| Scheme Year | 2026 |

Why This Loan Scheme Matters in 2026

Access to capital is still a major problem in Pakistan.

Banks demand collateral. Interest rates remain high.

The Punjab government business loan scheme 2026 removes these barriers by offering:

- Interest-free options

- Easy online application

- No heavy collateral for micro loans

- Special quotas for women and minorities

This makes the scheme ideal for startups, freelancers, shop owners, and home-based businesses.

Who Can Apply for CM Punjab Loan Scheme 2026?

Basic Eligibility Criteria

To apply, you must:

- Be 18–50 years old

- Hold a valid CNIC

- Be a Punjab resident

- Have a business idea or running business

- Not be a defaulter of any government loan

Special Quotas

The Punjab government has reserved quotas to promote inclusion:

- 30% for women entrepreneurs

- 10% for differently-abled persons

- 5% for minorities

These applicants often receive priority processing.

Loan Categories & Interest Rates

1. Micro Loans (PKR 100,000 – 500,000)

Best for:

- Startups

- Freelancers

- Online sellers

- Home-based businesses

Interest Rate:

- 0% for women

- 0% for differently-abled individuals

2. Small Business Loans (PKR 500,001 – 2,000,000)

Best for:

- Registered shops

- Small manufacturing units

- Service providers

Interest Rate:

- 3% for youth and startups

3. Medium Enterprise Loans (PKR 2,000,001 – 5,000,000)

Best for:

- Business expansion

- Machinery purchase

- New branches

Interest Rate:

- 5% fixed

Step-by-Step Guide to Apply for CM Punjab Loan Scheme 2026

Step 1: Visit the Official Portal

Go to the official Punjab government website:

punjab.gov.pk

Always apply through the official portal only.

Step 2: Register Your Account

Enter:

- CNIC number

- Mobile number

- Email address

- Secure password

A verification code will be sent to your phone.

Step 3: Fill the Application Form

Provide:

- Personal information

- Business details

- Loan amount required

- Expected income

Upload your business plan in PDF or Word format.

Step 4: Upload Required Documents

Prepare these documents in advance:

- CNIC copy

- Passport-size photo

- Proof of residence

- Business registration (if available)

- Last 6-month bank statement

Step 5: Submit & Track Application

After submission, you will receive a tracking ID via SMS or email.

Use it to monitor your application status online.

Step 6: Verification & Interview

Some applicants may be called for:

- Document verification

- Phone interview

- Physical visit

Keep your phone active.

Common Mistakes to Avoid

Many applications get rejected due to small errors. Avoid these:

- Incomplete business plan

- Wrong CNIC details

- Fake bank statements

- Applying multiple times

A clear and realistic business plan increases approval chances.

Benefits of CM Punjab Loan Scheme 2026

- No heavy interest burden

- Government-backed security

- Flexible repayment period

- Inclusive for women and youth

- Supports real economic growth

This scheme is designed for real people, not corporations.

FAQs About Chief Minister Punjab Loan Scheme

Is the CM Punjab Loan Scheme 2026 interest-free?

Yes. Micro loans for women and differently-abled persons are 100% interest-free.

Can students apply for this loan?

Yes, if they meet age and CNIC requirements and submit a solid business plan.

Is collateral required?

Most micro loans do not require collateral. Terms depend on loan category.

How long does approval take?

Usually 3 to 6 weeks, depending on verification.

Can I apply again if rejected?

Yes. You can reapply after correcting mistakes.

Conclusion

The Chief Minister Punjab Loan Scheme 2026 is a powerful opportunity for anyone who wants to start or expand a business in Punjab. With interest-free loans, easy online access, and strong government support, this scheme removes financial fear.